Running a business is no easy task and to add more complications to it, you’ve got to track its growth on a regular basis.

One such means to monitor your growth is by tracking payment metrics.

But because of the plethora of available options, you might end up investing in the wrong payment metric software.

Well, not anymore..!!

This blog incorporates the list of best payment metrics software in terms of their pricing and features, for PayPal and Stripe.

| Let’s have a look at the comparison of various Payment Metrics Software | |||||

| Services | Priving | Multilingual Checkout Page | 25+ Currency Support | Unlimited Revenue | Invoice Billing |

| Pabbly Subscriptions | $5 per month | ✔ | ✔ | ✔ | ✔ |

| Zoho Subscription | $ 29 per month | ✖ | ✔ | ✖ | ✔ |

| Putler | $50 per month | ✖ | ✖ | ✔ | ✔ |

| MRR.io | $19 per month | ✖ | ✖ | ✖ | ✔ |

| ProfitWell | $0 per month | ✖ | ✖ | ✖ | ✖ |

For more information click on the following blogs –

- PayPal analytics: List of 10 best tools

- Dunning Management – Stop Payment Related Churn

- Payment Tracking Software

- Recurring Billing Software

Rest assured, the listed payment analytics software will keep track of your business’s MRR, ARR, ARPU and other relatable payment metrics.

1. Pabbly Subscriptions –

Pabbly Subscriptions is a top class payment analytics software through which you can easily handle PayPal & Stripe transitions simultaneously.

It provides a user-friendly dashboard using which business details like total sales, refunds, total revenue, canceled subscription and recently added customers can be viewed.

My personal recommendation is with Pabbly Subscriptions, f you are looking for an affordable solution to handle payment transactions from PayPal & Stripe.

With Pabbly Subscriptions you can effectively manage Subscription Bills and Analyze Payments both from a single dashboard and all these features will cost you $5 for monthly usage.

Features –

- The Sales Analytics feature provides you with all the complex details related to refunds, canceled subscriptions, net sales, customers essential and more.

- Pabbly Subscriptions allows you to create unlimited products, plans, and invoices. You can also customize invoices and filter details easily.

- You will also get an advanced API framework which will simplify the integration process of Pabbly Subscriptions inside other applications and software.

- Different reports related to Net Revenue, Monthly Recurring Revenue, new as well as active customers & subscribers are generated in the report section.

Pricing –

To avail of the benefit of this software, you can pay for the plan which suits best –

- Starter- As for starting with the software, you can go for the starter plan that provides all the basic features at just $5 per month.

- Rookie- To avail of this plan, you have to spend $29 per month. And you can collect one-time & recurring payments from up to 1,000 users.

- Pro-If you want to acquire this plan, the price is $59 per month. Moreover, it provides you with features like collect unlimited revenue from multiple payment gateways in more than 25 languages and a lot more.

- Advanced- Lastly, to opt for this plan, the cost is $99 per month. Plus, you can provide a client portal and avail features like custom domain, affiliate system, etc.

2. ProfitWell –

The SaaS obsessed software, for the time-being only works with Stripe and couple of other integrations. If not using a definitive payment gateway, ProfitWell transactions API allows the account holder to add subscriptions in their account for on-point SaaS metrics.

Despite having limited integrations, it provides the best payment and SaaS analytics along with the KPI break down functionality in an extremely generous plan.

Features-

- ProfitWell monitors the cash flow of your business and shows the insights on transaction metrics like refunds, monthly/annual subscription fees, etc.

- This payment metrics software also allows you to monitor your customers and their corresponding details.

- And, if you get stuck anywhere or face any problems, you can contact ProfitWell’s knowledgeable SaaS experts.

Pricing-

It’s the pricing that makes ProfitWell one of the best payment metrics software available in the market.

It provides all the core analytics for FREE.

Although, there are two chargeable additional plans/products –

- RETAIN*TM – Retain helps SaaS companies by preventing Churn and charge them on the basis of recovered revenue.

- RECOGNIZED*TM – This plan charges its customers $1000/month and in return manages subscription and GAAP metrics.

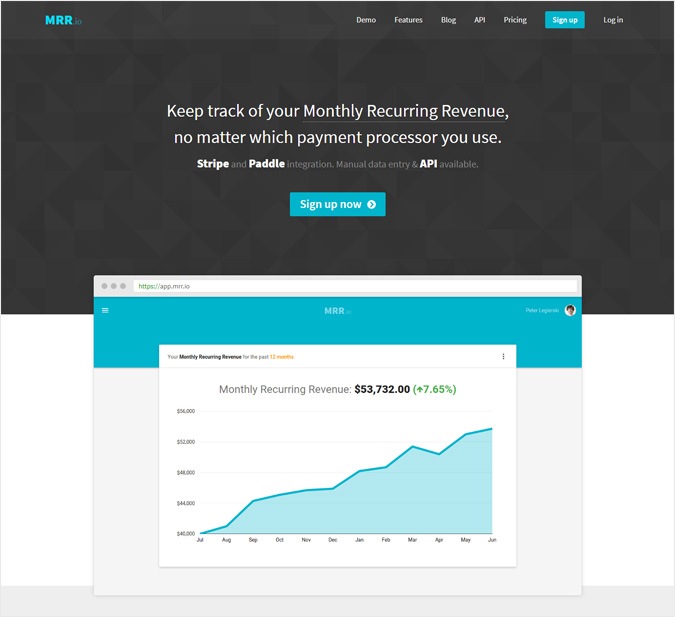

3. MRR.io –

Another basic payment analytics software which dedicates its services to Stripe. Aside from providing a secure payment processing environment, it also facilitates its customers to manually add and manage subscriptions, charges, and refunds in your account.

MRR.io permits its users to monitor over 20+ metrics with just a click.

Features –

- MRR.io being a decent payment metrics tool also allows you to develop highly advanced email reports, forecast metrics and analyze the cohort.

- It ensures the regular automatic update of data to provide instantaneous metrics insights.

- If the customers don’t have a Stripe account, MRR.io provides its API to programmatically import data from PayPal and other payment processors.

Pricing –

MRR.io provides only two yet highly affordable pricing plans –

- Basic – This is a FREE plan of MRR.io which is valid for 100 paying customers and 3 team members. All the metrics analysis and basic email reports are featured in this plan.

- Pro – This plan costs a mere $19 for 250 paying customers and unlimited team members. But the increasing number of customers will also lead to an increase in plan price –

– 1000 paying customers – $69/month.

– 2500 paying customers – $129/month.

– 5000 paying customers – $199/month.

– Above 5000 paying customers – Contact the sales team.

Pro plan includes a 30 day free trial with all the features of the Basic plan, cohort analysis, advanced email reporting and email support.

MRR.io allows its users to continue using the Basic plan until they have less than 100 paying customers. You will not be able to access the software if you exceed the customer’s limit and will be prompted to upgrade the plan.

4. Putler –

This app comes under the category of ideal payment metrics software and regarded as the complete analytics tool.

It works on the principle of Connecting, Aggregating and Processing.

Putler allows you to connect all the segments of financial software like payment gateways, shopping cart and Google analytics. Followed by aggregating the data (transactions, customer details, recurring payments, etc.) and ultimately processing the accumulated data and show them in the form of graphs and charts.

Features –

- Apart from PayPal and Stripe, Putler offers numerous options for payment gateways and e-commerce platforms integration.

- It offers distinct features for PayPal and Stripe –

PayPal – Analytics & reporting, instant transaction details, product & sales analytics (like refunds, most profitable customers, etc.), quick subscription management (processes like an update, cancel, etc.) and a lot more.

Stripe – Putler provides almost the same features for Stripe when compared to PayPal but have a dedicated dashboard for subscription analytics.

- Meanwhile, PayPal will be getting its own subscription analytics dashboard soon.

- Putler, being a decent payment analytics solution provides us 153+ KPIs.

Pricing –

Putler provides us 14 days FREE trial for three affordable pricing plans along with common features like 153+ metrics & reports, website & visitor analytics, growth advice from experts, etc.

- Starter – $25/month for 500 orders per month, 3 integrations and 2 years historical data.

- Growth – $75/month for 3000 orders per month, 7 integrations, 5 years historical data and advanced features like issuing refunds, subscription management, RFM segmentation and Inbound/Outbound API.

- Scale – Everything in growth plan + 10000 orders per month, 20 integrations, 7 years historical data and dedicated account manager.

5. Zoho Subscription –

The availability of multiple payment gateways like PayPal and Stripe, Zoho Subscription is definitely one of the prominent names in the category of payment metrics software.

One of the greatest positive points of Zoho is that with only one account, you get to access all the Zoho apps like Zoho Books, Zoho Expense, Zoho Invoice, etc.

Features-

- Zoho allows its user to operate on the test account with dummy data and a test payment gateway for as long as they want. Once the users are ready to bill their customers, they can create a live account.

- Zoho Subscription provides its users the liberty to use various services in a single software like payment analytics, subscription analytics, dunning management, etc.

- This payment analytics software also permits you to export your reports in the CSV format.

Pricing –

Zoho subscription provides two extremely affordable pricing plans on the monthly and yearly basis. The software offers the same basic & advanced features for both the plans.

- Standard – $29 ($290 for the yearly plan) for 500 customers and 3 users.

- Professional – $69 ($690 for the yearly plan) for unlimited customers and users.

Note – Zoho promises to give 2 months off on both the plans if the yearly plan is chosen. Also, the pricing plan excludes transaction charges which have to be paid directly to the payment gateways.

6. Zuora-

A basic yet highly efficient payment analytics software for Stripe which notifies its users of various Stripe events like payment, subscriptions, etc.

Zuora also permits its users to monitor all the necessary payment metrics and subscription metrics through a common dashboard.

Features –

- This payment metrics software assures instantaneous overview as it calculates metrics every two minutes.

- Every payment and subscription metrics has its own dedicated web page which means more detailed information.

- With the added feature of Stripe webhook, Zuora gives instant notification alerts for events like payments, disputes, subscriptions, invoice, etc.

7. Databox –

This payment metrics tool offers 30+ pre-built data connectors out of which PayPal and Stripe are the predominant ones.

Databox can be used on mobile (Datacards) as well as on big screens (Datawalls) for optimized viewing.

Features-

- Databox provides various dashboard templates for Stripe and PayPal to work on.

- The payment analytics service offers distinguishing features for PayPal and Stripe –

PayPal available KPIs – Balance, total sales, refunds, fees, transactions by status, etc.

Stripe available KPIs – Net revenue, LTV, ARR, ARPU, monthly/weekly revenue churn, subscriptions, etc.

- Databox, when integrated with either Stripe or PayPal, allows you to manage various businesses like e-commerce, SaaS, etc.

Pricing –

The payment metrics service gives four pricing plans on a monthly and yearly basis –

- Free – Under this plan, you get to integrate 3 data connections, operable by 3 users and 3 databoards for FREE. Data is refreshed on a daily basis.

- Basic – $59/month ($49/month when billed annually) for 10 data connections, 5 users and 10 databoards. Data is refreshed every hour.

- Business – $299/month ($249/month when billed annually) for 50 data connections, 20 users, and 50 databoards. Data is refreshed every hour.

- Custom – For bigger analytics needs, you have to get in touch with the sales team for a custom plan. The plan is guaranteed to offer unlimited data connections, users, and databoards with the real-time data update.

For every plan (except custom), you get to try it FREE for 15 days and with Business plan features.

8. Revealytics –

Revealytics currently offers its analytics services only for Stripe but will be providing analytics for multiple payment gateways in the near future.

The software has the potential to showcase all the payment metrics and other KPIs with just a single click.

Features –

- Revealytics is packed with the extremely powerful dashboard which highlights all the important payment and SaaS metrics.

- This payment metrics service also provides an option to integrate Slack so that you can share and schedule reports on daily/weekly and monthly basis.

- This service also sends you instant notifications about major events and changes.

Pricing –

Revealytics offers pricing plans on the basis of your monthly gross revenue which includes features like cohorts, all metrics dashboard & their descriptive breakdown and channels efficiency dashboard.

The most basic plan is FREE if your monthly revenue is less than or equal to $2000.

And, if your monthly revenue ranges from $2001 to $20,000 you will be charged $49/month.

For more details, a pricing calculator is available on the website which will automatically calculate your plan price based on your revenue.

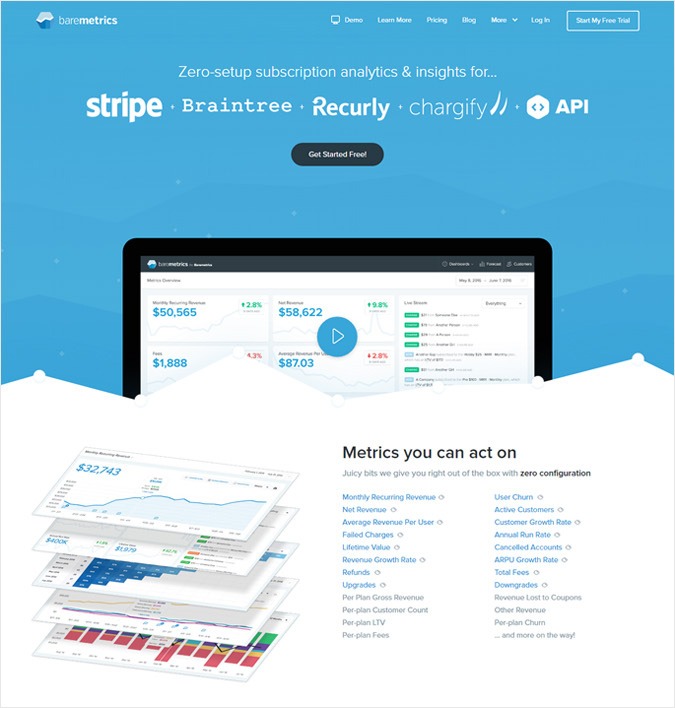

9. Baremetrics –

It is another example of Stripe based payment metrics software which requires zero setups for payment & SaaS metrics insights.

With the help of a real-time view of your payment metrics, you get to strengthen your business and amplify your growth.

Features –

- Apart from payment analytics, Baremetrics offers SaaS metrics and dunning management as their prime services.

- The metrics forecasting tool allows you to monitor metrics as projections so that you can fix your business practice before any harm is done.

- In-depth knowledge of every single customer (their MRR, LTV, payment history, etc.) can be obtained through Baremetrics’ dashboard.

Pricing –

Baremetrics offers four pricing plans with 2 weeks FREE trial, common advanced features (email reporting, historical metrics, forecasting, customer profiles, cohort analysis, etc.) and 60 days full money-back guarantee.

- Startup -It costs $50/month up to $10000 MRR.

- Professional – You need to pay $100/month up to $50000 MRR.

- Business – For this plan, the cost is $250/month up to $200000 MRR.

- Enterprise – To acquire this plan, th cost is $500/month up to $500000 MRR.

Along with the above-listed plans, Baremetrics provides an automated failed payment recovery system – Recover.

You can avail this service as an add-on with additional charges –

- It costs Up to $25/mo for up to $10k MRR

- You gotta pay$50/mofor up to $25k MRR

- For up to $50k MRR, you have to pay $75/mo

- This service costs $100/mo for up to $100k MRR –

- If you earn up to $200k MRR, then the cost is $150/mo

- You need to pay $300/mo for up to $500k MRR –

- For up to $1M MRR, the cost is $500/mo

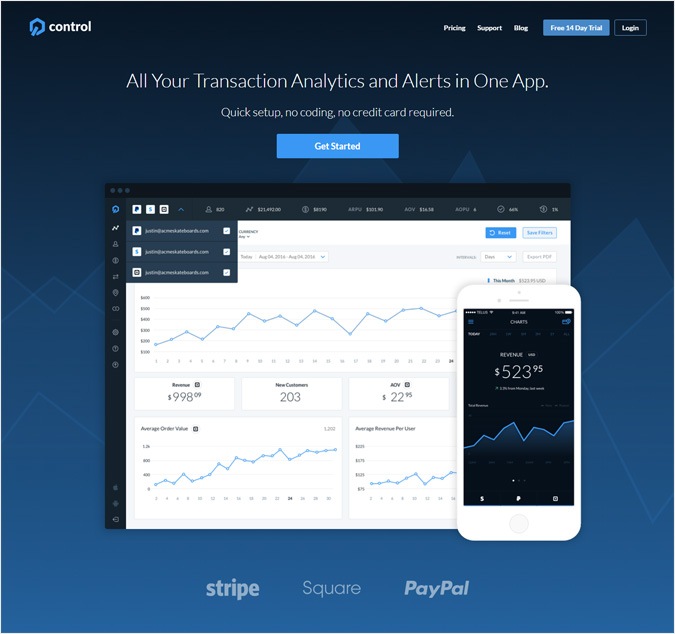

10. GetControl –

Highly acknowledged payment metrics software which shows all your transaction analytics for PayPal and Stripe account.

GetControl allows you to stay informed in spite of your location as you can access the software either through the web or through the mobile app available on App Store, Google Play, and Amazon Appstore.

Features –

- This payment analytics software allows you to add unlimited Stripe and PayPal account. Hence, you can monitor the metrics at a single place.

- Apart from providing payment analytics, GetControl offers SaaS and e-commerce analytics as well.

- This payment metrics tool is fully equipped to handle and block fraud in real-time even while you are away.

Pricing –

GetControl offers four pricing plans which are based on data points and billed either monthly or annually.

Data points simply are certain events from the connected payment gateways (new charge, new customers, new refund, etc.) that GetControl receives on its end for metrics monitoring.

- Starter – $19/month for up to 200 data points ($10 additional charge for extra 100 data points) with features like analytics for multiple payment platforms, SaaS & e-commerce, instant alerts and fraud prevention.

Considering you happen to generate an additional 100 data points apart from the allotted 200, you will have to pay –

$19 (base price) + $10 (additional data points charge) = $29 in total.

Similarly,

- Growth – $79/month for up to 750 data points ($20 additional charge for extra 500 data points) + everything in Starter plan and customer segmentation, filter charges by status, country, etc.

- Scale – $149/month for up to 10000 data points ($30 additional charge for extra 5000 data points) + everything in Growth plan and VIP support.

- Custom – Contact with sales team for pricing details. Ideal for businesses generating $250K+ sales and 10,000 transactions.

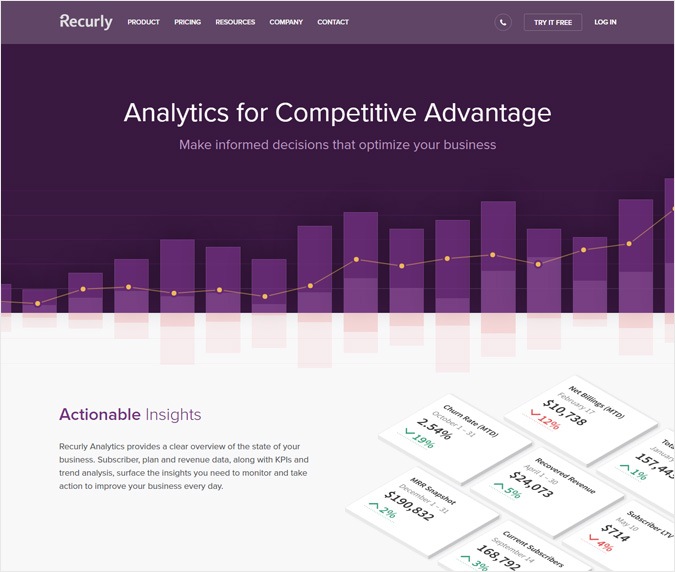

11. Recurly –

Recurly isn’t just a normal payment metrics software for PayPal and Stripe. Instead, it also offers other services like a plan, invoice and dunning management.

Apart from payment gateways, it also provides various other integrations like Salesforce, NewSuite, QuickBooks, MailChimp, etc.

Features –

- The best-in-class dashboard allows you to monitor every payment and transaction metrics.

- Recurly provides the option to customize reports like the addition of graphs, pie charts, currency, etc.

- The availability of the emailing service in Recurly allows you to automatically send email templates for events. These events can be account activation, a new subscription, subscription changed/expired, payment declined or refunded, etc.

Pricing –

This payment metrics software have three pricing plans –

- Core – $99/month + 1.25% of revenue + 10¢ per transactions for features like analytics, churn prevention, hosted payment pages, multiple API keys & Webhooks, etc.

Please note that this is just the base charge. You will be charged more according to your monthly revenue and number of transactions.

For example, you happen to generate $10,000 of monthly revenue with 100 transactions, the total sum of money you’d have to pay is –

$99 (base charge) + $125 (1.25% of $10,000 revenue) + $10 {10¢ per transaction (100 in our case)} = $234/month

Similarly,

- Professional – $299/month (base charge) + $125 (1.25% of $10,000 revenue) + $10 (10¢ per transaction) = $434/month for additional advanced features.

- Enterprise – If your business needs volume pricing then get in touch with the sales team for custom pricing details.

Conclusion –

I hope that after reading the blog, you are able to choose the best payment metrics software to analyze PayPal and Stripe payment metrics.

The above-listed payment software and services are the best in every aspect. Hence, the listing has been done on the basis of their monthly (annual in some cases) pricing plans. So that, if you are running low on funds, you can choose an apt and economical payment analytics service.

Another thing to notice is that the pricing plans listed are the fees charged by payment metrics software for their services alone. You will have to pay additional merchant processing fees by the gateways. That is 2.9% of the transaction amount + 30¢ per transaction (same for PayPal and Stripe).

Rest assured, all the software are capable enough to help you monitor payment metrics & overall business growth and also adhere to PCI compliant guidelines.

Consider reading these blog too –

Feel free to contact us for more details!

Thanks for reading!