This online loan management system gives flexible loan plans & savings module. So, the customer can adjust or customize as per their convenience.

Admin can manage all type of payments and configure the chart of accounts with GL codes. Here general Ledger is used to track financial transactions and to prepare financial reports.

Also, it comes with the loan term and conditions, interest calculation method and many helpful options for loan approval.

Primary Features Of Ultimate Loan Manager

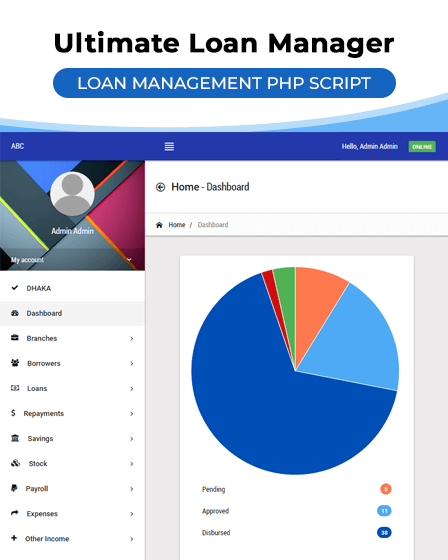

[su_icon icon=”icon: dashboard” size=”20″ shape_size=”24″ text_size=”18″]Powerful Dashboard[/su_icon]

Online loan management system comes with a multifunctional and powerful admin dashboard. Admin can add and manage new borrower with their personal and financial details.

Moreover, the admin panel gives complete details about the loan and collection statistics. There is an option available for the customizing payment method and customer profile.

[su_icon icon=”icon: bank” size=”20″ shape_size=”24″ text_size=”18″]Loan & Plans[/su_icon]

Admin has full control over the management system. So, he gives the approval to the customers, and add new loan plans, view loan application, manages interest charges and more.

[su_icon icon=”icon: paypal” size=”20″ shape_size=”24″ text_size=”18″]Payments[/su_icon]

Admin can customize the payment method as per their and customers convenience. Also, set the tax interest for an individual type of loan.

It comes with the following payment gateways:

- PayPal

- Stripe

- M-Pesa

[su_icon icon=”icon: bar-chart” size=”20″ shape_size=”24″ text_size=”18″]Accounting[/su_icon]

Admin can find the various accounting reports like trial balance, balance sheet, and profit and loss accounts and journal entries.

Also, it gives a complete detailing about the logging of a transaction. That shows a company’s debit and credit balances.

It provides the following account reports and statistics:

- Chart Of Account

- Journal Entries

- Ledger Entries

- Add Journal & Manual Entry

[su_icon icon=”icon: line-chart” size=”20″ shape_size=”24″ text_size=”18″]Reports[/su_icon]

Now with an updated version, admin can export the high-quality reports, borrower numbers, loan portfolio, saving reports, collection sheets and more.

[su_icon icon=”icon: user” size=”20″ shape_size=”24″ text_size=”18″]Borrowers Profile[/su_icon]

Admin will create the borrower’s unique profile with given Email address & password. So, customers can sign in and apply for the loan. Also, it allows the user to apply for multiple loans in the same duration.

[su_icon icon=”icon: code” size=”20″ shape_size=”24″ text_size=”18″]GL Codes[/su_icon]

The general ledger is a set of numbered account, which helps to track the financial transaction of the customers. Also. each account in the general ledger consists of one or more pages.

It keeps tracking the amounts as credits (right side), and amounts as debits (left side). With the help of GL, you can record the type of asset, liability, equity, revenue and expense and more.

[su_icon icon=”icon: envelope” size=”20″ shape_size=”24″ text_size=”18″]Email & SMS[/su_icon]

Registered users of Ultimate Loan Manager will receive email and SMS with every update and new loan plans. Admin can send bulk SMS and email to the customer.

You may also like: